Genre: Business & Money

Author: Craig Rowland

Title: The Permanent Portfolio: Harry Browne’s Long-Term Investment Strategy (Buy the Book)

Summary

Craig Rowland wrote his book The Permanent Portfolio: Harry Browne’s Long-Term Investment Strategy as a “how-to” manual for the average investor to create the Permanent Portfolio. This strategy involves an equal weighting in stocks, bonds, gold and cash that will protect the investor against any market condition.

Based on Harry Browne’s book Fail Safe Investing, Rowland outlines the underlying assumptions, historical performance and theory behind the Permanent Portfolio, then explains how to invest in each asset class and maintain these investments.

Rowland bases his assertions on one simple fact – in the long run, the average investor is better off investing in a passive strategy involving low-cost index funds than trying to actively manage a portfolio.

The decision to actively manage a portfolio implies the investor believes he or she can predict what will happen in the markets, and when changes will occur. Browne believed this is simply not possible, and that an investor should hold a portfolio that will perform well under any market conditions.

He outlines this and the other beliefs that shape the foundation of the Permanent Portfolio in what he referred to as the “16 Golden Rules of Financial Safety.” These rules are important when trying to understand the theory and strategy behind the Permanent Portfolio and help the investor to understand why investing in a strategy like this may be to their advantage.

The Permanent Portfolio is simple in structure and easy to maintain. The portfolio consists of only four asset classes – stocks, bonds, gold and cash, with 25% of the portfolio invested in each.

These holdings are based on four states of the economy that Browne argues are the only states in which an economy can function. These states are prosperity, deflation, recession and inflation. First, an economy is in a time of prosperity when productivity and profits are growing, unemployment is low, and interest rates are stable or falling.

This is when optimism is widespread and stocks are doing very well. Second, during deflation, an economy has experienced a shock which sets in motion a cycle of declining prices, falling interest rates

Third, Browne defined

During these periods, gold will perform well. The Permanent Portfolio is composed of the four asset classes that will typically perform well during each state of the economy. This will provide the investor with what Rowland describes as the ‘Holy Trinity’: growth, no large losses, and real returns.

Historically, the Permanent Portfolio has performed very well. Since 1972, this strategy has returned, on average, a nominal 9.5 percent per year, which is only slightly less than the 9.8 percent return seen in stocks over the same period.

Over 40 years, through all of the market cycles and bubbles, there have only been seven negative real returns for the Permanent Portfolio, and all of these losses were recouped very quickly. As a strategy that safely grows an investor’s wealth over time, the Permanent Portfolio lives up to its name.

Implementing the Permanent Portfolio is much more challenging than simply maintaining it. Rowland provides many tips and recommendations on how to decide which investments to include in each of the asset classes and explains to the reader the optimal way to invest in them. Once the portfolio is implemented safely and correctly, the investor simply needs to rebalance, if needed, every year.

When any of the four asset classes exceed 35 percent or drop below 15 percent of the portfolio, the investor should either sell or buy that asset to rebalance the portfolio back to the original 25% weight for each asset. This will ensure that investors are buying high and selling low, regardless of what their emotions are urging them to do.

All in all, Rowland’s book is an easy to follow instruction guide for investors looking to grow their wealth over a long time period. It explains in layman’s terms why the Permanent Portfolio is useful and what the investor can expect to achieve with its use.

It has done well historically and effectively hedges against each of the four market conditions that occur in the economy. This strategy will ensure that any investor can achieve growth, no large losses and real returns over time.

Introduction

The Permanent Portfolio: Harry Browne’s Long-Term Investment Strategy is designed as a how-to manual on implementing a Permanent Portfolio based on Harry Browne’s investment strategies. Based on Browne’s book, Fail-Safe Investing, Craig Rowland has explained how a Permanent Portfolio works in any economic condition and how to implement this very simple strategy in the real world.

Rowland bases his assertions on one simple fact – in the long run, most investors are better off investing in low-cost index funds instead of trying to actively manage their portfolio.

Markets are very complex and trying to predict the future with certainty is impossible.

Instead of believing the assertions that one investor can predict the market better than another, investing in this fail-safe, Permanent Portfolio can guarantee the investor safety, stability

The idea for a Permanent Portfolio was first proposed by Harry Browne in the 1970’s. His idea of a portfolio that can withstand any economic condition came after he had a very successful investment in gold, silver and the Swiss franc.

In the 1960’s Browne believed the gold standard would be broken in the US and, as a result, the prices of gold and certain other hard assets would soar. After publishing his book, How You Can Profit from the Coming Devaluation in 1970, Browne invested in his book’s suggested strategy.

In 1971, when President Nixon broke the gold standard, Browne did very well from the increase in gold after the ensuing inflation.

He needed a way to protect his profits once the bad inflation ended and devised a variation of the Permanent Portfolio. Under the original strategy, an investor would allocate their money across not only stocks, bonds

Over time, Browne simplified his Permanent Portfolio strategy to make it easier for any investor to implement and maintain. The modern Permanent Portfolio consists of 25% stocks, 25% bonds, 25% cash and 25% gold. In 1999, he published the theories behind the Permanent Portfolio and his 16 underlying investing rules in Fail-Safe Investing. Browne writes:

“The portfolio’s safety is assured by the contrasting qualities of the four investments – which ensure that any event that damages one investment should be good for one or more of the others. And no investment, even at its worst, can devastate the portfolio – no matter what surprises lurk around the corner – because no investment has more than 25% of your capital.”

In The Permanent Portfolio: Harry Browne’s Long-Term Investment Strategy, Rowland contends that the Permanent Portfolio discussed by Browne can be very successful over time, but the average investor needs an instruction manual on how to implement the strategy in the real world. This is where his book comes in.

Browne’s 16 Golden Rules of Financial Safety

In his book Fail-Safe Investing, Browne outlined 16 rules he believed are the foundation for the Permanent Portfolio. He called these the 16 Golden Rules of Financial Safety. Rowland contends that to understand the philosophy behind the Permanent Portfolio, the reader must first understand these rules.

First, as a basic premise, investors must accept that the markets are uncertain.

Once an investor learns to embrace uncertainty rather than fight it, a realistic strategy can be adopted which can deal with this uncertainty instead of trying to beat it. This is exactly what the Permanent Portfolio does. Keeping this premise in mind, the 16 Golden Rules of Financial Safety are:

- Your career provides your wealth: Most of the money an investor makes in his or her lifetime will be from his or her career; investing should only serve to supplement that income and allow his or her life savings to grow safely.

- Don’t assume you can replace your wealth: An investor should never assume that he or she can recoup a big loss, because he or she probably can’t. The author states, “Taking big risks with money you worked hard to earn is literally gambling with years of your life that you can’t get back.”

- Recognize the difference between investing and speculating: Investing is implementing a strategy that focuses on long-term results. Speculating is trading for short-term profits, trying to time the market, or any other high risk approach.

- No one can predict the future: A logical argument is made in Rowland’s book: if a person can accurately predict the market, why is he or she making media appearances about it instead of trading and profiting themselves? Rowland also argues it is strange for people who wouldn’t rely on a psychic each morning to accept the predictions of a commentator as fact on what the market is going to do. Simply stated, no one can predict what will happen in the markets.

- No one can time the market: This is a continuation of the previous rule. If an investor cannot predict what the markets are going to do, they cannot tell you when it is going to do it. Although some commentators make good calls, very few people can reliably time the market. For the very few, if any, people that can, they would not be selling their highly profitable ideas to the public.

- No trading system will work as well in the future as it did in the past: The finite nature of the markets dictates that a winning strategy cannot continue wining forever. Theoretically, if this were the case, the trader who found such a strategy would own the market. In reality, if there is a system that has consistently beat the markets, soon its lucky streak will end and it will take a chunk of your investment down with it. “Past performance does not guarantee future results.”

- Don’t use leverage: “Using leverage is the single fastest way to lose everything you own.” When the markets are doing well, it seems very attractive to start levering up and make much higher returns. However, as soon as the markets start to turn down, they will take your life savings with them.

- Don’t let anyone make your decisions: No one cares more about your success in investing than you do. The rules contend that is it very important to understand the difference between seeking professional advice and simply turning money over to someone who will make the decisions for you. A third party often adds little value to the portfolio, but charges a fee and may take large, unnecessary risks with your money.

- Don’t ever do anything you don’t understand: If the investor does not fully understand a financial product, they cannot completely understand the risks associated with it and may be taking on larger than expected risks. Strategies do not have to be complicated to make substantial returns. The rules state, “If you don’t understand how an investment works within about five minutes, walk away.”

- Don’t depend on any one investment, institution, or person for your safety: Under this rule, the author mentions examples including the failed banks of the financial crisis, Bernie Madoff, and MF Global. If an investor puts too much faith in one entity, they could be severely disappointed if large losses or fraud occurs. It is better to spread the wealth between institutions to ensure the investor cannot lose everything at once.

- Create a bulletproof portfolio for protection: Like the Permanent Portfolio, the best strategies to build long-term wealth are ones which provide protection in any economy. No matter what unexpected event occurs and no matter what the markets are doing, the investments should be safe from serious damage.

- Speculate only with money you can afford to lose: Looking back at Rule 3, the author likens speculating to gambling. Simply put, if completely losing the investment will affect your life plans, the investor should not speculate. The Permanent Portfolio strategy includes a ‘Variable Portfolio’ that can be used for speculation purposes with money the investor can afford to lose.

- Keep some assets outside the country in which you live: Storing some assets outside an investor’s home country allows him or her to be geographically diversified. This will protect him or her against natural or manmade disasters, or any event where the government confiscates private property. Although this is not common, mass confiscation of private citizens’ property has been done in the United States in the past.

- Beware of tax-avoidance schemes: When building a portfolio, tax implications can be taken into account and an investor can minimize his or her tax obligation legally. Under no circumstances should an investor illegally avoid paying taxes, or fall for a scheme which forces them to do so.

- Enjoy yourself with a budget for pleasure: The rules point out that we don’t know how much time we have on this planet. Although it is important to save for retirement and other big life events, it is also important to have a balance that allows the investor to enjoy himself or herself.

- Whenever you’re in doubt about a course of action, it’s always better to err on the side of safety: If an investor is ever having difficulty understanding an investment or course of action, it is always better to be conservative and err on the side of caution. This is better than taking a risk that could wipe out an investor’s entire life savings.

Although primarily meant for investing, these rules can teach us lessons about life as well. Harry Browne summarized:

“The rules of safe investing are little different from the rules of life; recognize that you live in an uncertain world, don’t expect the impossible, and don’t trust strangers. If you apply to your investments the same realistic attitude that produced your present wealth, you needn’t fear that you’ll ever go broke.”

Historical Performance

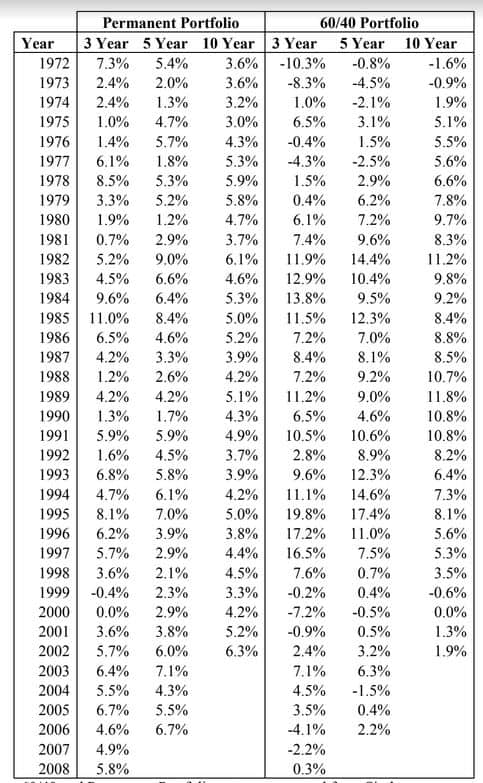

With all the promises of safe, steady returns from the Permanent Portfolio, it is important to understand how it has performed throughout history. Rowland describes the portfolio’s performance as obtaining ‘The Holy Trinity’: growth, no large losses, and real returns.

When analyzing historical data since 1972, the Permanent Portfolio strategy has returned, on average, a nominal 9.5 percent per year (which is only slightly less than the 9.8 percent average nominal return stocks had over the same period). The worst year was 1981, but even then, the portfolio was only down approximately 5 percent, which greatly outperformed the stock market.

This brings us to the second part of ‘The Holy Trinity’, no large losses. This portfolio has been remarkable when it comes to minimizing losses, which is extremely important considering it takes a higher percentage gain than the original loss to recoup the loss. The third piece of ‘The Holy Trinity’ is considering real returns instead of nominal returns.

Over 40 years, there were only 7 years where the real returns were negative, and the portfolio was able to recoup the losses in a very short time period after each occurrence. As a means of safely growing wealth over time, it appears the Permanent Portfolio lives up to its name. A table of multi-year, real returns for the Permanent Portfolio and

Four Economic Conditions

The Permanent Portfolio approaches diversification differently than most investment strategies. Instead of emphasizing the correlation between asset classes like most strategies, the Permanent Portfolio pays no attention to this.

Browne’s reasoning is that the correlations between asset classes can change, as we saw in 2008 when most asset classes came crashing down together. Instead, Browne divides the economy into four

He argues that at any point in time, the economy is experiencing one or more of these conditions positioning the Permanent Portfolio to take advantage of the best performing asset.

The four economic conditions Browne identified are:

- Prosperity

- Deflation

- Recession

- Inflation

Browne defined periods of prosperity as times when productivity and profits are growing, unemployment is low, and interest rates are stable or falling.

He also notes optimism is widespread and stocks and bonds typically do very well. Second, deflation occurs when an economic shock sets in motion a cycle of declining prices, falling interest rates

Third, Browne defined a recession as a ‘tight-money recession’ like the United States experienced in the early 1980’s. This is when the central bank decides to raise interest rates to combat high inflation. An unfortunate consequence of this action is a recession.

These periods are temporary and normally only last 12 to 24 months. During these recession periods, cash performs the best of all the asset classes. Rowland also notes that during these periods, cash can be useful to have in the portfolio as an emergency fund or as a reserve to buy the other asset classes while their prices are low.

Inflation is the fourth and final economic condition. During inflationary periods, there is too much money circulating in the economy and as a result, prices and interest rates rise. Gold performs the best during these periods.

By holding an equal weight of each asset class, the Permanent Portfolio essentially takes an equal bet on each of the four market conditions.

This will prepare the investor for whatever condition the market has in store for them. It is important to remember the market is always changing, but it is impossible to know how it is changing.

This makes it impossible to choose the winning and losing asset classes in advance. By holding stocks, bonds, cash

Stocks

During periods of prosperity, the economy is growing while inflation is not too high, interest rates are normally low and perhaps falling, and the economy is expanding – all of which create the perfect environment for stocks to thrive.

To profit during times of prosperity, Rowland recommends owning a broad-based stock index fund such as one that tracks the S&P 500 without trying to beat it.

He states that when choosing a fund, the investor must consider ones that:

- Track a total stock market index or S&P 500 index

- Have an expense ratio below 0.50 percent per year

- Are passively managed

- Are from well-established companies with a track record for index investing

- Are 100 percent invested in stocks at all times

Some examples of these for US investors include:

- Vanguard Total Stock Market Mutual Fund (Ticker: VTSMX)

- Vanguard Total Stock Market Exchange Traded Fund (Ticker: VTI)

- iShares Russell 3000 Index Exchange Traded Fund (Ticker: IWV)

- Fidelity Spartan Total Stock Market (Ticker: FSTMX)

- Schwab Total Stock Market (Ticker: SWTSX)

Rowland notes that when trying to decide between a mutual fund and an exchange-traded fund (ETF) the investor must look at trading costs. Often the investor must pay commission and the bid/ask spread when trading an ETF.

These fees can be extremely expensive over time and greatly erode the value of the portfolio.

Another important note Rowland makes is that when building the Permanent Portfolio, international exposure is not necessary. International investments add more risk to the portfolio and if the investor is exclusively spending and living within a certain country, he or she should invest in that country.

This is especially true in the United States because the U.S. stock market is composed of many large international companies that are responsible for about half of the world’s economic output. This provides international exposure to the U.S. investor without subjecting them directly to currency risk.

Bonds

Like stocks, bonds do well in times of economic prosperity. They provide a steady stream of income to the investor, and help offset some of the volatility in the stock market. Although this is important, bonds provide the most value to the Permanent Portfolio during times of deflation.

It is widely understood in the markets that stocks outperform bonds, but this is not always the case. It is true that in some long-term periods, stocks outperform bonds, but it depends on the period the investor is looking at.

There are periods in which bonds outperform stocks in the long-term, and although they occur infrequently, September 30,

This quote illustrates that although rare, bonds can outperform stocks in the long run. Over shorter, more frequent time periods, this is also the case. An investor’s time horizon may fall within a period where bonds outperform stocks.

For the Permanent Portfolio, only 25 to 30 year US Treasury Bonds are appropriate because:

- They have no default risk

- Their long maturity provides maximum volatility to profit from periods of deflation

- They are nominal (fixed rate) bonds, meaning they do not have inflation adjustments

built in - They avoid other bond problems such as credit risk, political risk, and currency risk

There are three ways to buy these bonds.

First, the investor can buy directly from the auction at the U.S. Treasury. This is not always convenient because an auction may not occur when the investor is looking to purchase the bonds. Second, the investor can buy on the secondary market through a brokerage firm.

This is Rowland’s recommended way to purchase the required bonds. It is most likely more convenient than purchasing them directly from the U.S. Treasury, but the investor still holds them directly. The third option is through a bond fund.

Rowland discourages this if it is possible to buy the bond outright because it may be hard to find a fund that holds exclusively 25 to 30 year U.S. Treasury bonds. If the investor decides to use option one or two, once the bonds start to reach 20 years to maturity, he or she should sell the bonds and use the proceeds to purchase new 25 to

Cash

The Permanent Portfolio is very different in its recommendation to hold 25% of the portfolio in cash (or cash equivalents). Within this strategy, cash is designed to act as a stabilizer to help the portfolio in times of volatility. Cash is also useful as a place to hold interest, dividends or capital gains from other assets, have on hand when rebalancing, and as an emergency fund if the investor is short on cash.

Within the Permanent Portfolio, it is recommended the investor hold his or her cash in U.S.

Treasury Bills (t-bills) with maturities of 12 months or less. These t-bills can be purchased through the same channels discussed earlier regarding the U.S. Treasury Bonds. Again, Rowland recommends holding the t-bills directly instead of purchasing through a fund.

Gold

Within the Permanent Portfolio, gold is considered portfolio insurance. It can provide returns during periods of high inflation, political uncertainty, and periods of negative real interestrates. It does best during inflationary periods when the other asset classes are lagging.

Rowland notes that although gold is highly volatile on its own, when incorporated into the Permanent Portfolio it actually reduces overall volatility.

There are several ways to invest in gold.

The first requires the purchase and storage of physical gold bullion. The investor will need to pay for storage in a safe location and

There are a few banks in the United States that offer custody accounts, where they will store the gold for you without holding it on their balance sheet. There are two kinds of these custody accounts – allocated and unallocated.

If the investor chooses the allocated account, the bank provides the investor with a specific lot of gold held in the investor’s name. If he or she chooses the unallocated account, it is slightly cheaper, but held in a pooled account where the investor has a claim to a portion of the pool.

In this case, the gold is not stored in the investor’s name, which can be dangerous in periods of uncertainty. Rowland recommends that no matter how the investor decides to invest in physical gold, he or she holds some of it outside of the United States to provide some geographic diversification.

This will protect the investor against natural or manmade

The third and final way to invest in gold is to do it through a fund. Although this is not the recommended approach by Rowland, it is better than if the investor does not invest in gold at all.

If a fund is the only option for the investor, Rowland recommends the following exchange-traded or closed-end funds:

- iShares Gold ETF (Ticker: IAU)

- StreetTracks Gold ETF (Ticker: GLD)

- Physical Swiss Gold ETF (Ticker: SGOL)

- Sprott Physical Gold Trust (Ticker: PHYS)

- Central Fund of Canada (Ticker: CEF)

- Central Gold Trust of Canada (Ticker: GTU)

- Canton Bank of Zurich ETF (Ticker: ZGLD)

Implementing the Permanent Portfolio

Now that the investor understands what the Permanent Portfolio is and what it is designed to do, he or she can start to implement it in their own accounts. The first key concept is to buy all of the assets at once. If the investor decides now is the best time to buy stocks but not gold, this defeats the underlying assumption of the portfolio.

Not only will the Permanent Portfolio not work unless all asset classes have a 25% weight within the overall portfolio, but in this case, the investor would be trying to time the market.

The portfolio is based on the assumption that investors cannot do this successfully so Rowland argues it is best to buy all of the assets at once, regardless of price.

When deciding how to implement the portfolio, Rowland describes four levels of protection that an investor can choose:

- Level 1 – Basic: In this level, the investor has purchased the entire portfolio in ETFs and/or mutual funds. This level will allow

a quick and cheap implementation of the Permanent Portfolio. However, it does not allow for an investor to hold the bondsdirectly, or the physical gold. - Level 2 – Good: This level is comprised of ETFs and/or mutual funds for stocks, cash

and most gold while the investor purchases the bonds and some gold directly. Here, holding the bonds directly reduces fund manager risk and some of the gold holdings are physical and stored locally. - Level 3 – Better: In level 3, stocks and cash are owned through ETFs and/or mutual funds, bonds are owned directly and all gold is owned physically and stored at a bank or other secure location. This level allows protection against shocks to the financial sector.

- Level 4 – Best: Level 4 allows for stocks and cash to be held through ETFs and/or mutual funds, bonds are owned directly, and 100% of gold holdings is physical and split between domestic and international storage. This international storage of gold would provide the investor with geographic diversification in the event of a natural or manmade disaster, or government confiscation. This level gives the investor the highest level of protection against any serious threat to his or her life savings.

Maintaining the Permanent Portfolio is much easier than deciding which assets within each asset class the investor wants to hold. Once the portfolio is set up, the investor will rebalance once a year, but only if an asset’s weight has grown beyond 35% or dipped below 15% of the total portfolio weight.

For example, if gold has grown to 36% of the portfolio and bonds have dropped to 14%, the investor would sell some of his or her gold holdings (sell high) and buy more bonds (buy low) to rebalance the entire portfolio to its original weightings. Rebalancing in this way maintains the strategy of the Permanent

To withdraw from the portfolio, Rowland recommends subtracting from the cash balance until the 15% threshold is met.

Once that occurs, the investor would rebalance the portfolio like normal. If the investor would like to add to the portfolio, Rowland contends that the investor should buy the worst performing asset instead of distributing the wealth equally to ensure the investor is continuing to buy low and sell high.

As noted earlier, Rowland stresses that the Permanent Portfolio is designed to be effective inside of the investor’s economy. If the investor resides outside of the U.S., he or she should replicate the strategies explained in this book using his or her own country’s currency and markets.

He also notes this strategy is designed to work in a country where the government is not corrupt. If an investor resides within an emerging country, or any country where the government cannot be trusted, the investor should find a market that is very similar to his or her own country, but with a stable government and market system.

It is also useful to mention Rowland’s dedication to institutional diversification.

He suggests when opening brokerage accounts, the investor should split assets across institutions. This would protect the investor against any unexpected freezes on one account, any problem with one of the institutions, and could help with identity theft if a criminal obtains access to one of the investor’s accounts.

If this occurred, the freeze or criminal would only have access to a portion of the investor’s savings. This also applies when investing in ETFs or mutual funds – Rowland recommends investing in two different institutions’ funds within the portfolio.

For extra safety, it would be ideal to invest a portion of the investor’s assets in two different institutions’ funds for each applicable asset class (for example, invest in both Fidelity’s and Vanguard’s Total Stock Market Funds).

Conclusion

All-in-all, Craig Rowland’s The Permanent Portfolio: Harry Browne’s Long-Term Investment Strategy offers some interesting recommendations and strategies for investors to follow. The Permanent Portfolio’s rationale assumes most investors can achieve better returns by passively investing in index funds than they can actively investing.

Markets are uncertain and nobody can predict or time the markets – the Permanent Portfolio embraces this and recommends a portfolio composition that can protect the investor from any market environment. Each asset class is designed to do well in a specific market environment and over time, it has produced stable returns.

If an investor chooses to use this strategy, it can give him or her peace of mind to know that he or she is protected in any market. Even if the portfolio does produce a negative return, history has shown that it should not be such a dramatic loss that the investor cannot make it up during the next year.

Rowland adds to Harry Browne’s strategy by offering

Britt always taught us Titans that Wisdom is Cheap, and principal can find treasure troves of the good stuff in books. We hope only will also express their thanks to the Titans if the book review brought wisdom into their lives.

This post has been slightly edited to promote search engine accessibility.